Gratuity Payout Revised in 2025: The New Labour Law 2025 has introduced important changes to gratuity calculation and payout rules, bringing greater clarity and fairness for employees. Gratuity remains a key retirement benefit for salaried workers completing long-term service. With updated provisions, employees can now better understand how much gratuity they are entitled to receive.

What Is Gratuity and Who Is Eligible

Gratuity Payout Revised in 2025- Gratuity is a lump-sum payment given by an employer to an employee as a reward for continuous service. Under current rules, an employee becomes eligible after completing at least 5 years of service in an organization. It applies to private sector, government employees, and establishments covered under the Payment of Gratuity Act.

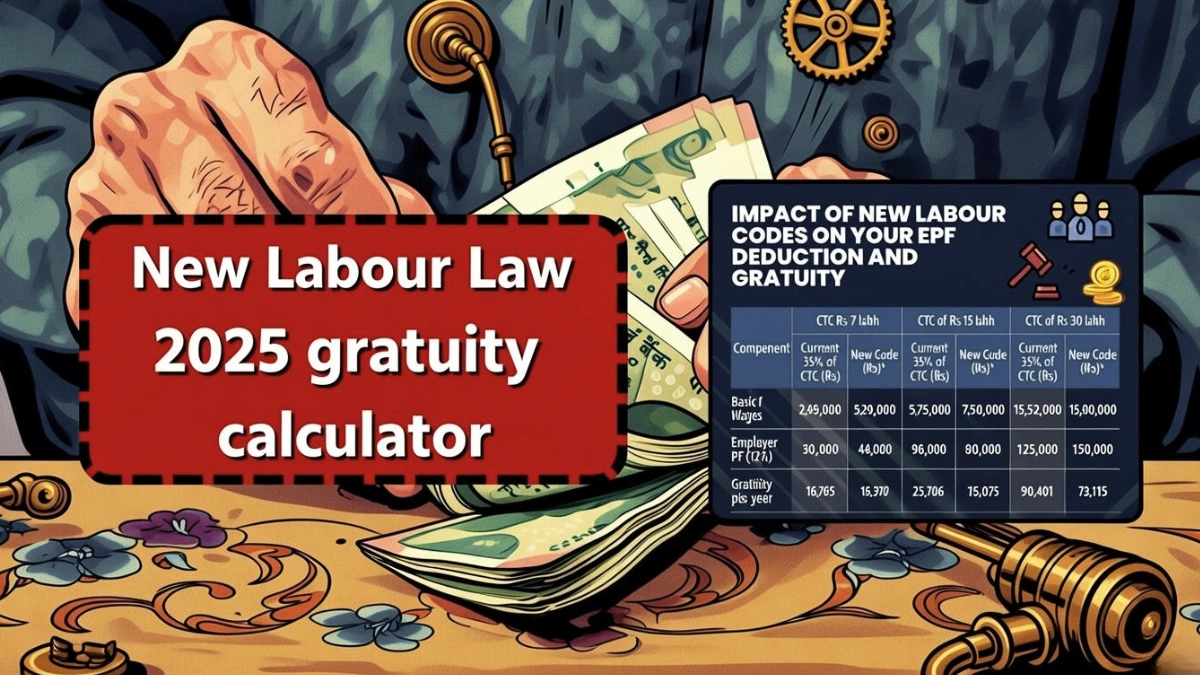

What Changed Under New Labour Law 2025

The 2025 labour law update focuses on transparent calculation, faster payouts, and better coverage. The calculation method remains standardized, but stricter timelines for payment and digital tracking have been emphasized. The law also strengthens employee rights in case of delayed gratuity payments.

Gratuity Calculation Formula Explained

Gratuity is calculated using a fixed formula prescribed by law. It is based on the employee’s last drawn basic salary plus dearness allowance (DA) and total years of service. Any service period above 6 months is rounded off to the next full year.

Gratuity Formula:

Gratuity = (Last Drawn Salary × 15 × Years of Service) ÷ 26

Gratuity Calculation Example (Simple)

| Details | Amount |

|---|---|

| Last drawn Basic + DA | ₹30,000 |

| Total years of service | 10 years |

| Calculation | (30,000 × 15 × 10) ÷ 26 |

| Total Gratuity Amount | ₹1,73,077 |

This example helps employees clearly understand how the final gratuity payout is calculated under the updated law.

Maximum Gratuity Limit in 2025

As per existing provisions, the maximum gratuity limit remains ₹20 lakh. Any amount beyond this limit is not mandatory for employers unless specified in company policy. The Labour Law 2025 continues this cap while ensuring timely payments.

Tax Rules on Gratuity Amount

Gratuity received by government employees is fully tax-free. For private sector employees, gratuity is tax-exempt up to the notified limit as per income tax rules. Any excess amount is taxable under the applicable income tax slab.

Key Benefits of the New Gratuity Rules

The updated labour law ensures faster settlements, digital records, and stronger employee protection. Employees can now track gratuity claims more easily and face fewer disputes. This makes gratuity a more secure retirement benefit.

Conclusion

The New Labour Law 2025 strengthens gratuity benefits by improving transparency and payout efficiency. With a simple calculation formula and clear eligibility rules, employees can confidently plan their long-term financial security. Understanding gratuity calculations helps workers maximize their lawful benefits.

Disclaimer: This article is for informational purposes only. Gratuity rules, limits, and tax treatment may change based on government notifications. Employees are advised to consult official labour law notifications or financial advisors for personalized guidance.